Just compensation includes not just the impact to the property actually taken but expands to include impacts to the larger parcel.

Michigan law recognizes an expansive approach to evaluating just compensation. For example, if only a portion of a property is taken, just compensation takes into account damages to the remainder of that property. This jury instruction summarizes damage to the remainder issues, which are typically the most heavily contested matter in a condemnation case.

M Civ JI 90.12 Partial Taking

This case involves what is known as a “partial taking”; that is to say, the property being acquired by the condemning authority is part of a larger parcel under the control of the owner.

When only part of a larger parcel is taken, as is the case here, the owner is entitled to recover not only for the property taken, but also for any loss in the value to his or her remaining property.

The measure of compensation is the difference between (1) the market value of the entire parcel before the taking and (2) the market value of what is left of the parcel after the taking.

In valuing the property that is left after the taking, you should take into account various factors, which may include: (1) its reduced size, (2) its altered shape, (3) reduced access, (4) any change in utility or desirability of what is left after the taking, (5) the effect of the applicable zoning ordinances on the remaining property, and (6) the use which the condemning authority intends to make of the property it is acquiring and the effect of that use upon the owner’s remaining property.

Further, in valuing what is left after the taking, you must assume that the condemning authority will use its newly acquired property rights to the full extent allowed by the law.

Damages to the remainder are not limited to a particular, legally described property. Rather, just compensation must be paid for the impacts upon an entire parcel, with parcel subject to a special definition contained in the Uniform Condemnation Procedures Act. “‘Parcel’ means an identifiable unit of land, whether physically contiguous or not, having substantially common beneficial ownership, all or part of which is being acquired, and treated as separate for valuation purposes.”

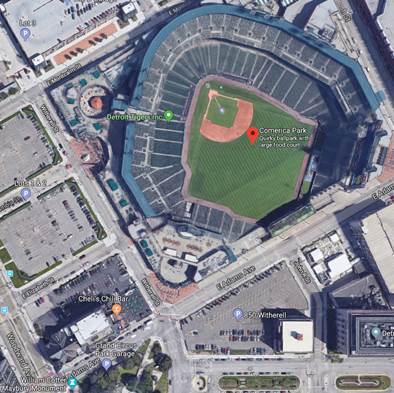

This recognizable aerial photograph illustrates the issue. Early in my career, I was heavily involved in the condemnations that resulted in the acquisition of property for Comerica Park and Ford Field. At one point, the Detroit/Wayne County Stadia Authority contemplated acquiring the parking lot owned by the Central United Methodist Church at southwest corner of the Stadia footprint, just north of Cheli’s Chili Bar.

Based upon the definition of parcel, the acquisition of the Church’s parking lot would have required payment of damages to the remainder for the Church itself. These claims would have been astronomical to the extent that the Church would have been limited in its operations by the inability of its parishioners to park during events such as matinee baseball games and Detroit Lions football games. The Stadia authority wisely demurred and did not acquire the parking lot.

This statute has several nuances that must be recognized.

First, to be a “parcel,” the property need not be “physically contiguous.” The idea that a parking lot physically adjacent to the church would be the same parcel is fairly non-controversial. However, the same rule would apply if the parking lot were across the street. It would also apply to a manufacturing facilities that perform interrelated tasks but are separated by some distance. The classic appraiser manual example involves a pineapple orchard on one Hawaiian island and the canning facility on another island.

Additionally, the parcels need only be under “substantially common beneficial ownership.” This is critical because it means that the definition looks beyond how the property is titled. For example, if a building and parking lot servicing the building are owned by separate limited liability companies with the same or similar enough ownership to operate in conjunction, the definition is satisfied. This rule recognizes that real estate is often held by discreet entities but are used as part of a larger enterprise.

This rule is in play in my ITC cases involving the Breckenridge Subdivision. Those properties are being subjected to vegetation management easements. The houses are separated from the towers themselves and a public recreation trail by a strip of land owned by the homeowners association, of which the individual property owners have an interest. Further, the association allows the homeowners to plant vegetation on the association property. Many owners have done so in order to provide an aesthetic amenity that also screens the homes from the Trail itself as well as the existing transmission lines. The acquisition of an easement allowing that vegetation to be removed from the association property requires consideration of the negative impact on the owners’ homes.

This rule can also come into play in agricultural cases. For example, if drain tiles service multiple fields, damages stemming from impacts to those tiles by utility easements in one field must be considered for the other fields over which no easement is acquired.

Understanding rules like the definition of parcel is critical to being paid just compensation. Unfortunately, property owners often do not know these rules and agency appraisers may not evaluate the issue. For that reason, experienced eminent domain counsel should always be consulted.

If you have any questions or are being subjected to a taking, please feel free to contact me.